Do you know how much tax you pay on superannuation contributions and withdrawals?

The amount of tax depends on several factors, and it’s possible to minimise the amount you pay by understanding how the tax on super works. Tax on super is generally a lower rate than the tax on your income, and by using a few smart strategies, you can both minimise your tax bill and maximise your super investment.

The tax on super rules are the same for all super funds, whether self-managed, an industry fund, a default employer fund or another regulated fund.

Tax on Contributions

Contributions made to your super fund before tax are taxed at a flat rate of 15% and called concessional contributions. This applies to employer super guarantee contributions, salary sacrifice and sole trader contributions. As your super investments grow, you’ll also pay 15% tax on the earnings.

After-tax contributions are not taxed again. If you, your spouse or your employer make contributions from your after-tax income, or you make other contributions not classed as a tax deduction, these amounts won’t be taxed in the super fund.

Carry Forward Provisions to Minimise Tax

There are limits to how much you can contribute to your super fund each year. You could get an excess contributions tax bill if you contribute over the threshold.

However, from 2020, new rules allow you to make extra concessional contributions in some situations without having to pay additional tax. The carry forward rule means that you may be able to contribute more than the concessional contribution cap if eligible, without extra tax charges.

Tax on Withdrawals

Your preservation age, how the funds are paid to you, the type of income stream and other factors affect the tax on super withdrawals. Some withdrawals may be taxed, and others are tax-free. For example, after-tax contributions are tax-free when you withdraw funds, but concessional contributions are taxable.

Want to Make the Most of Your Super?

Tax on super can be complicated! We’d love to review your super and discuss ways to minimise the tax on super contributions and withdrawals. You can receive great tax benefits by making extra contributions while still working and utilising the carry forward provisions.

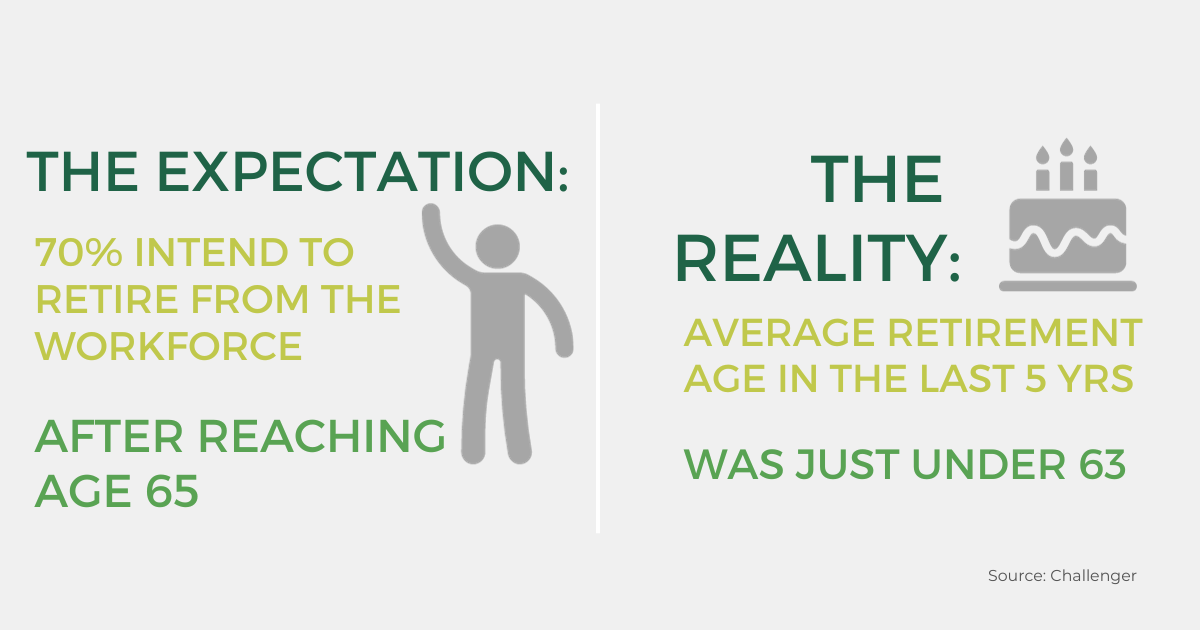

Whether you’re starting in the workforce, nearing retirement or actively withdrawing from your super fund, we can help you make the most of your super.